Charting the Course: Opportunities for Bank Card Accessibility After Insolvency Discharge

Navigating the world of credit card gain access to post-bankruptcy discharge can be a complicated task for individuals looking to reconstruct their economic standing. From safeguarded credit cards as a stepping rock to potential courses leading to unsecured credit rating opportunities, the journey in the direction of re-establishing credit reliability calls for mindful consideration and informed decision-making.

Comprehending Credit History Basics

A credit score is a numerical representation of a person's credit reliability, indicating to lending institutions the level of risk associated with extending debt. A number of factors add to the estimation of a credit rating rating, consisting of settlement background, amounts owed, size of debt background, brand-new credit, and kinds of credit history used. The quantity owed family member to offered credit score, additionally recognized as credit report use, is an additional critical aspect influencing credit report scores.

Secured Credit Scores Cards Explained

Guaranteed charge card supply a useful financial tool for people seeking to restore their credit rating background adhering to a personal bankruptcy discharge. These cards call for a down payment, which generally establishes the credit scores limitation. By utilizing a secured credit score card properly, cardholders can show their credit reliability to potential lenders and progressively enhance their credit report.

One of the vital advantages of protected charge card is that they are more available to individuals with a limited credit report or a damaged credit history - secured credit card singapore. Considering that the credit line is protected by a deposit, providers are much more ready to approve candidates who may not certify for traditional unsecured charge card

Bank Card Options for Rebuilding

When looking for to reconstruct credit after personal bankruptcy, exploring various credit score card choices customized to individuals in this economic situation can be advantageous. Guaranteed credit rating cards are a prominent choice for those seeking to restore their credit report. By providing a down payment that normally establishes the credit line, people can show responsible credit score behavior to lenders. Furthermore, some financial establishments supply credit builder lendings, where the consumer makes repaired regular monthly payments right into a financial savings account or CD, ultimately acquiring access to the funds and possibly improving their credit history. An additional option is becoming an accredited individual on someone else's credit report card, permitting individuals to piggyback off their credit report and possibly improve their very own score. Prepaid cards, while not directly influencing credit report, can assist with budgeting and monetary discipline. Ultimately, some lenders concentrate on post-bankruptcy charge card, although these usually come with higher charges and rate of interest prices. By exploring these bank card alternatives for restoring, people can take aggressive steps towards improving their financial standing post-bankruptcy.

How to Get Unsecured Cards

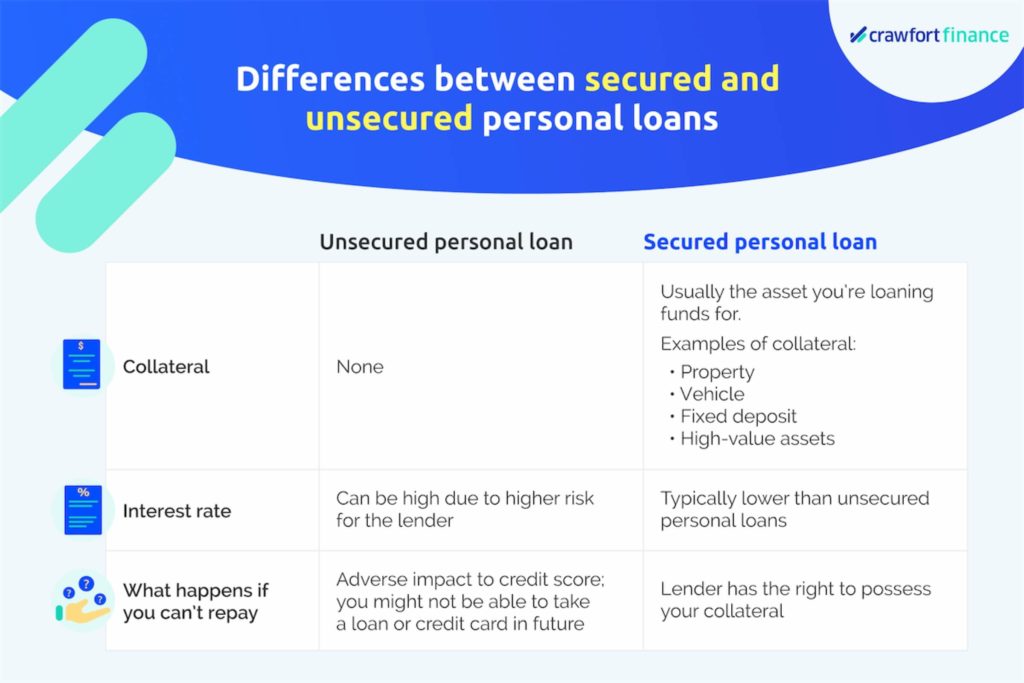

To receive unsafe credit site link report cards post-bankruptcy, people require to show better credit reliability via liable economic monitoring and a background of on-time settlements. Among the main actions to get unsecured charge card after personal bankruptcy is to consistently pay costs on schedule. Prompt payments display responsibility and dependability to prospective lenders. Preserving low credit history card balances and staying clear of accumulating high levels of financial debt post-bankruptcy likewise enhances creditworthiness. Monitoring credit scores reports routinely for any kind of mistakes and contesting inaccuracies can even more enhance credit rating ratings, making individuals extra appealing to credit report card issuers. In addition, individuals can take into consideration making an application for a safeguarded charge card to restore credit score. Guaranteed charge card need a money down payment More Bonuses as collateral, which lowers the risk for the company and permits individuals to show responsible charge card usage. Gradually, liable Resources monetary habits and a positive credit rating can lead to qualification for unsafe bank card with better benefits and terms, aiding individuals restore their financial standing post-bankruptcy.

Tips for Accountable Charge Card Use

Building on the structure of enhanced credit reliability developed through liable monetary administration, people can improve their general economic health by applying essential ideas for accountable debt card usage. In addition, keeping a reduced credit application ratio, ideally below 30%, demonstrates responsible credit scores usage and can positively influence credit history scores. Abstaining from opening up multiple new credit card accounts within a short period can prevent potential credit rating damage and extreme financial debt build-up.

Final Thought

To conclude, individuals who have actually filed for insolvency can still access bank card through numerous alternatives such as protected charge card and rebuilding credit rating (secured credit card singapore). By recognizing credit rating basics, receiving unsafe cards, and exercising responsible bank card usage, people can gradually reconstruct their credit reliability. It is necessary for people to thoroughly consider their financial circumstance and make educated decisions to enhance their credit scores standing after personal bankruptcy discharge

Numerous factors add to the estimation of a credit rating score, consisting of repayment history, amounts owed, size of credit scores background, brand-new credit history, and kinds of credit history made use of. The amount owed family member to readily available credit scores, additionally understood as debt application, is an additional critical factor influencing credit score ratings. Keeping track of credit score records on a regular basis for any mistakes and challenging inaccuracies can additionally improve credit report scores, making people a lot more appealing to credit card companies. In addition, keeping a reduced credit rating usage ratio, ideally below 30%, shows accountable credit report usage and can favorably affect credit history scores.In verdict, people that have filed for bankruptcy can still access credit rating cards through numerous choices such as safeguarded credit rating cards and restoring credit history.